Why do we need an alternative to QuickBooks?

QuickBooks is one of the most widely accepted Bookkeeping and Accounting tool, trusted by thousands of businesses and individuals alike. Quicken and QuickBooks Online are its individual-bookkeeping and cloud-based accounting tools respectively. While QuickBooks particularly is no pretty bad in itself, things get a bit worrisome when QuickBooks Online is considered. Their cloud-based tool is pretty clumsy and cumbersome to handle, with the lack of proper approach to User Experience. It also suffers from a lack of proper Bank Re-conciliation, which form one of the important aspects of a business. Its high price tag and sufficiently inadequate ease-of-use is one of the many reasons thousands of users are flocking to their alternatives. Their competitors are reporting that many of their new users were previously based on QuickBooks.

5 Best QuickBooks Alternatives

So, you must be pretty much getting the gist of everything behind the troubles associated with QuickBook and we will be taking a look at some of the best alternatives to it. Here are the 5 Best QuickBooks alternatives.

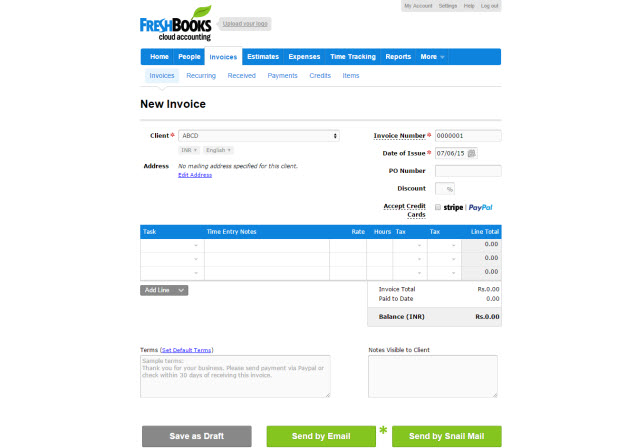

1. FreshBooks

FreshBooks is one of the biggest competitor of QuickBooks and offers tools that are well taken to by both small businesses and corporate(s) alike. This premium accounting and invoicing tool offers a completely web-based solution to your accounting needs and also offers Android and iOS applications for managing accounts and invoices on the go. At the home page, you can Create a new Client, Invoice, Estimate, Expenses, Payment or a new Project. For making Invoices, you would need to create a Client and then head over to the Invoices tab shown above to get started. You can add tasks, Items, Discounts, Tax and much more to these invoices. You can also make invoices on recurring payments to certain clients and also track payments. Provide your clients with an Estimate for a specific task or item, get it approved and then convert it into an invoice for receiving payment for the same. Tracking expenses is easy with FreshBooks and Time Sheet allows time-tracking of projects for their billed time. Reports creation including Profit and Loss reports, Invoice details and Tax Summary are some of the many reports that could be created using FreshBooks. The mobile applications make it easy for managing invoices and accounts on the go. Faster payments, Better tracking and Award-winning customer support team makes FreshBooks one great alternative to QuickBooks. Key Features: Send Invoices, Accept Payments, Auto Payment Reminders, Team Timesheets, Import Expenses, Recurring expenses, Profit and Loss, Tax Summary and more. Platforms Supported: Web-based (All major web browsers supported), Android and iOS Applications Pricing: $9.95/mo (5 Clients), $19.95 (25 Clients), $29.95 and $39.95 (Unlimited Clients and more features) Visit Website

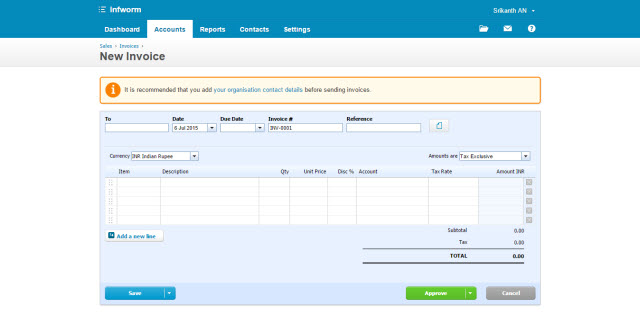

2. Xero

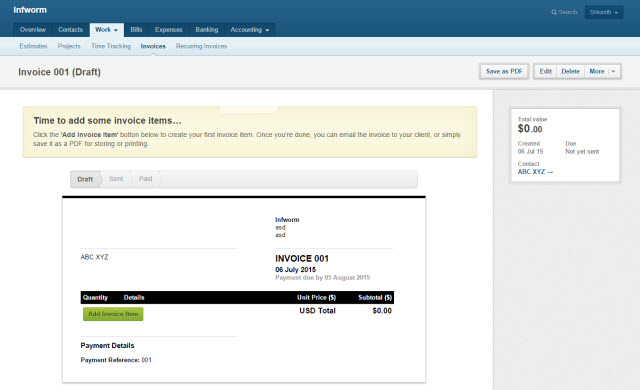

Xero Accounting and Invoicing is a cloud-based tool that offers iOS and Android applications too for managing invoices and accounts on the go. With over 500,000 subscribers to its name, Xero is the best accounting and invoicing tool, only next to QuickBooks in terms of number of subscribers. It offers a comprehensive accounting and invoicing solution to businesses of all shapes and sizes. Online account management, Auto Bank reconciliation, Inventory management and Smart reports are some of the key features of Xero. It is widely praised by its users for its ease-of-use and a clean User Interface that doesn’t make you search for tasks. Creation of Invoices is one of key prime areas of Xero with a detailed Invoice layout to its name. The Invoicing structure in Xero provides an option to add Discounts to individual terms, unlike the Discount on the entire bill found in many other invoicing tools. Apart from Invoicing, Quotes is another key feature that lets you provide a cost estimate to your clients, before billing them out. Scheduling of payments and handling expenses is also pretty easy with Xero. This tool’s Dashboard makes it easier to have an overlook on all the projects at hand and provides simplicity to your accounts management. Employee and third-party payroll creation is also supported by Xero. Keep track of all of your bills by adding them to your Bills section, along with a Due Date associated with them. All in all, one of the most preferred Accounting, Bookkeeping and Invoicing tool right after QuickBooks is Xero. Key Features: Overview Dashboard, Bank re-conciliations, Invoicing, Reports, 3rd Party integrations, Payments and more. Platforms Supported: Web-Based (All major web browser supported), iPhone/iPad and Android apps. Pricing: $20/mo per user (5 Invoices, 5 Bills, 20 Bank Re-conciliations), $30/mo per user (Unlimited everything, no multi-currency accounting), $40/mo per user (Multi-currency accounting support). Visit Website

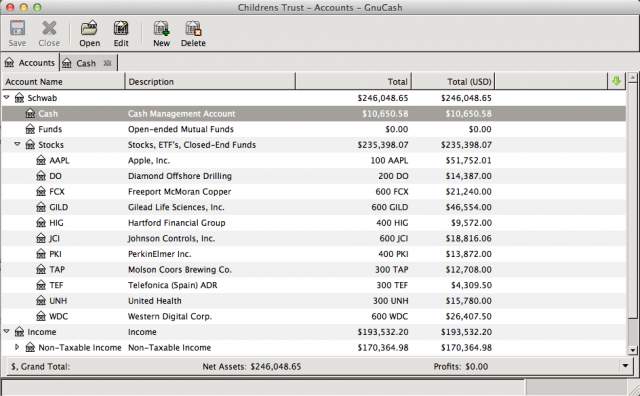

3. GNUcash

GNUcash is an open-source, multi-platform tool to all of your financial accounting needs. If paid premium online or desktop accounting tools is what you’re not looking for, GNUcash is a great open-source alternative to QuickBooks and the like. It is the most comprehensive accounting open-source software, that also features its own Android app. Transactions involved in all small businesses is a two-way process – Expenses and Income. To perfectly attuned to both Assets and Liabilities requires a Double Entry management, provided by GNUcash. A Register is also included with GNUcash that makes it easy to track financial transactions within an organization. Using this tool, you can also take care of recurring transactions by scheduling them well in advance of their due dates. GNUcash provides automated reports for Tax Summary, Profit & Loss and more. It goes further to even include Bar-charts and Scatter Plot graphs to easily visualise the accounting situation. Cash flow categorization and Account reconciliation makes sure that your transactions are on track. Invoicing, Payrolls, Bill Payment, Support for multiple currencies, Localization, Mortgage assistant, Report Import/Export and many other features make GNUcash nothing less of a full-blown Premium accounting product. Being an open-source tool with a big developer community to back it, GNUcash is one great free alternative to QuickBooks. Key Features: Reports, Graphs, Financial calculations, Bonds/Mutual funds accounts management, Assets and Liabilities management with Double Entry, Register, Bank reconciliation, Reports, Scheduling transactions and more. Platforms Supported: Windows, Mac OS X, Linux and Android application. Pricing: Free Visit Website

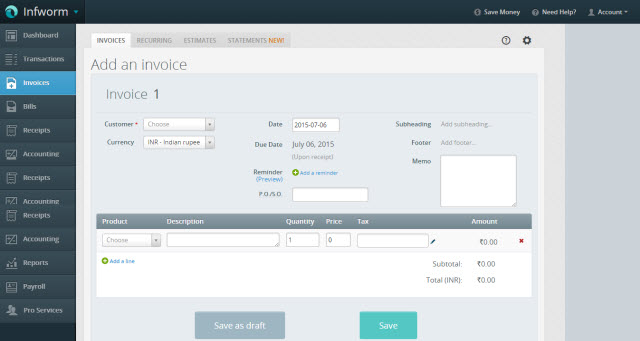

4. Wave Accounting

Wave Apps’ Accounting is one of the best free accounting and invoicing app for startups and Small businesses with less than 10 employees on board. For more number of employees, their premium plans would have to be called into action. Wave Accounting provides all of the key accounting and invoicing tools that you would ever need on their cloud-based network. Everything is easily accessible through their dashboard and keeping track of invoices, expenses or other reports is pretty straightforward. Recurring expenses, Estimates and Statements are some of the key Invoicing features in Wave Accounting app. Tracking past transactions is easy with Wave Apps providing a way to sync your Bank account with its tool, doing away with any necessary manual entry of data to the app. Using its iOS and Android applications, Bills could be pictured and and stored to your Wave Apps Accounting profile. Adding Bills with due dates and managing Accounts in the form of Assets/Liabilities is pretty easy with Wave Apps Accounting. These Accounts could also be easily exported as a CSV or Excel Spreadsheet. Wave Accounting Reports provide Balance Sheet, Income tax statement, Profit & Loss reports and many more automatically. You can also manage payrolls of your employees with Wave Accounting, provided that they are based in US or Canada, for obvious taxation reasons. Wave Accounting is a great alternative to QuickBooks and makes sense for small businesses who could use the tool for free, given their lower number of employees. Key Features: Connect with bank accounts for auto-entries, Professional reports, Invoicing and Payroll management, Bill/Invoice reminders, Bank Reconciliation, Expense tracking and more. Platforms Supported: Web-based (Supports all major web browsers). Pricing: Free (Unlimited Invoicing, Personal financing and reports), $14/month (Payrolls, Direct Deposit and more). Visit Website

5. FreeAgent

If you are a freelancer or a small business looking for a tool to just handle your accounting and tax related activities, FreeAgent should be the right fit for your needs. With tools tackling Estimate and Invoice creator to generating Sales Tax reports for your business, FreeAgent has got your covered on all fronts. The dashboard provides a collective view of all the ongoing processes at a single place and allows you to branch out to your choice of action. This dashboard provides a birds eye view of Profits/Loss, cash flow and an invoice timeline. Estimates are pretty common among freelancers and small businesses and FreeAgent lets you create multi-currency and multilingual professional estimates in minutes. Beautifully designed Invoices could be selected from the templates provided by FreeAgent and they could be sent off to the clients after adding in the specific details to it. A coffee on the go daily could still add to your expenses and you somehow might miss on your calculations. FreeAgent make it easy to track expenses of all kinds, both for your business and your personal finance management. Manage your projects easily and along with all of your expenses and invoices tracked, see if they are on the right track and churning out profits. Timesheet reporting is one of the most unique feature on FreeAgent and you can now track all of your billed time working on projects. Automatic bank transaction invoicing, automated accounting and easy generation of sales tax reports are some of the key features that are the icing on the cake for FreeAgent users. Key Features: Invoicing, Billing, Expenses, Projects, Time tracking, Banking, Tax estimates and more. Platforms Supported: Web-based (Supports all major web browsers). Pricing: $20/month (30 days free trial, no credit card required). Visit Website SEE ALSO: Best PayPal Alternatives for 2015 What do you think of these Accounting and Invoicing tools for your Small Business, Startup or personal financial tracking needs? Share your thoughts and comments regarding these tools below.